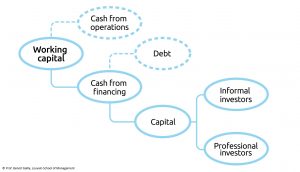

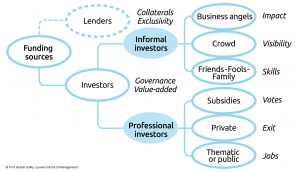

The lack of track record, the ambiguity and the specificity of most innovation projects mean that innovation managers should consider alternative specialized sources of financing, such as informal and professional investors, to (co-)invest in the development of their opportunity.

The lack of track record, the ambiguity and the specificity of most innovation projects mean that innovation managers should consider alternative specialized sources of financing, such as informal and professional investors, to (co-)invest in the development of their opportunity.

Innovation managers and entrepreneurs looking for specialized outside (co-)investors must identify, target and engage effectively the right type of financial stakeholders, based on available offers, expectations and potential value-added.

Innovation managers and entrepreneurs looking for specialized outside (co-)investors must identify, target and engage effectively the right type of financial stakeholders, based on available offers, expectations and potential value-added.

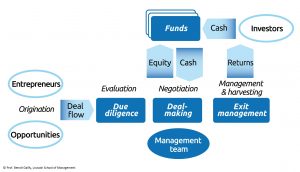

Innovation managers and entrepreneurs can in some cases leverage the value-added and support of venture capitalists as (co-)investors, provided they master the business model of these specialized investors, their selection criteria and their negotiation process.

Bibliography

Sources of financing: why cash is costly

Keywords: adverse selection, agency costs, early-stage investors, information asymmetry, funding, smart money

- (Book) Usselman, Steven W., Naomi R. Lamoreaux, and Kenneth Sokoloff. “Financing Innovation in the United States, 1870 to the Present.” (2007): 317.

- (Video) Innovating the funding of innovation: Skyler Fernandes at TEDxConnecticutCollege

- (Article) Aghion, P., & Bolton, P. (1992). An incomplete contracts approach to financial contracting. The Review of Economic Studies, 59(3), 473-494.

- (Article) Anton, J. J., & Yao, D. A. (2002). The sale of ideas: Strategic disclosure, property rights, and contracting. The Review of Economic Studies, 69(3), 513-531.

- (Article) Bester H. (1985) “Screening vs. Rationing in Credit Markets with Imperfect Information”, The American Economic Review; Vol. 75, No. 4 (Sep., 1985), pp. 850-855

- (Article) Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6), 613-673.

- (Article) Carpenter, R. E., & Petersen, B. C. (2002). Capital market imperfections, high‐tech investment, and new equity financing. The Economic Journal, 112(477), F54-F72.

- (Article) Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19(2), 261-283.

- (Article) Coff, R. (2003). Bidding wars over R&D-intensive firms: Knowledge, opportunism, and the market for corporate control. Academy of Management Journal, 46(1), 74-85.

- (Article) De Clercq, D., & Dimov, D. (2008). Internal knowledge development and external knowledge access in venture capital investment performance. Journal of Management Studies, 45(3), 585-612.

- (Article) Freel, M. S. (2007). Are small innovators credit rationed?. Small Business Economics, 28(1), 23-35.

- (Article) Giudici, G., & Paleari, S. (2000). The provision of finance to innovation: a survey conducted among Italian technology-based small firms. Small Business Economics, 14(1), 37-53.

- (Article) Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- (Article) Kenney, M., & Zysman, J. (2019). Unicorns, Cheshire cats, and the new dilemmas of entrepreneurial finance. Venture Capital, 21(1), 35-50.

- (Article) Landier, A., & Thesmar, D. (2008). Financial contracting with optimistic entrepreneurs. The Review of Financial Studies, 22(1), 117-150.

- (Article) Lee, C., Lee, K., & Pennings, J. M. (2001). Internal capabilities, external networks, and performance: a study on technology‐based ventures. Strategic Management Journal, 22(6‐7), 615-640.

- (Article) Mason, C. M., & Harrison, R. T. (2002). Barriers to investment in the informal venture capital sector. Entrepreneurship & Regional Development, 14(3), 271-287.

- (Article) Mina, A., & Lahr, H. (2015). The pecking order of innovation finance. Academy of Management Proceedings, 1, 12786.

- (Article) Myers, Stewart C. and Majluf, Nicholas S., Corporate Financing and Investment Decisions when Firms Have Information that Investors Do Not Have (July 1984). NBER Working Paper Series, Vol. w1396, pp. -, 1984.

- (Article) Nanda, R., & Rhodes-Kropf, M. (2016). Financing risk and innovation. Management Science, 63(4), 901-918.

- (Article) O’brien, J. P. (2003). The capital structure implications of pursuing a strategy of innovation. Strategic Management Journal, 24(5), 415-431.

- (Article) Stiglitz, J. E. (2000). The contributions of the economics of information to twentieth century economics. The Quarterly Journal of Economics, 115(4), 1441-1478.

- (Article) Stuart, P., Geoff Whittam, and Janette Wyper. “The pecking order hypothesis: does it apply to start-up firms?.” Journal of Small Business and Enterprise Development 14.1 (2007): 8-21.

Navigating the innovation financing fauna: financial stakeholders

Keywords: business angel, crowdfunding, FFF (friends, fools and family), investment funds, seed investing

- (Book) Landström, Hans, and Colin Mason, eds. Handbook of Research on Business Angels. Edward Elgar Publishing, 2016.

- (Book) Simon Parker (ed) The Life Cycle of Entrepreneurial Ventures Kluwer; 2006

- (Video) Choose the Right Investor for Your Startup HBR Video

- (Article) Aghion, P., Van Reenen, J., & Zingales, L. (2013). Innovation and institutional ownership. American Economic Review, 103(1), 277-304.

- (Article) Ahlers, G. K., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39(4), 955-980.

- (Article) Belleflamme, P., Lambert, T., & Schwienbacher, A. (2014). Crowdfunding: Tapping the right crowd. Journal of Business Venturing, 29(5), 585-609.

- (Article) Berger, M., & Hottenrott, H. (2021). Start-up subsidies and the sources of venture capital. Journal of Business Venturing Insights, 16, e00272.

- (Article) Bruton, G., Khavul, S., Siegel, D., & Wright, M. (2015). New financial alternatives in seeding entrepreneurship: Microfinance, crowdfunding, and peer‐to‐peer innovations. Entrepreneurship Theory and Practice, 39(1), 9-26.

- (Article) Bugl, B. M., Balz, F. P., & Kanbach, D. K. (2022). Leveraging smart capital through corporate venture capital: A typology of value creation for new venture firms. Journal of Business Venturing Insights, 17, e00292.

- (Article) Burtch, G., Ghose, A., & Wattal, S. (2013). An empirical examination of the antecedents and consequences of contribution patterns in crowd-funded markets. Information Systems Research, 24(3), 499-519.

- (Article) Burtch, G., Ghose, A., & Wattal, S. (2015). The hidden cost of accommodating crowdfunder privacy preferences: A randomized field experiment. Management Science, 61(5), 949-962.

- (Article) Buterin, V., Hitzig, Z., & Weyl, E. G. (2019). A flexible design for funding public goods. Management Science, 65(11), 5171-5187.

- (Article) Carpentier, C., & Suret, J. M. (2015). Angel group members’ decision process and rejection criteria: A longitudinal analysis. Journal of Business Venturing, 30(6), 808-821.

- (Article) Cumming, D. (2007). Government policy towards entrepreneurial finance: Innovation investment funds. Journal of Business Venturing, 22(2), 193-235.

- (Article) Croce, A., Tenca, F., & Ughetto, E. (2017). How business angel groups work: rejection criteria in investment evaluation. International Small Business Journal, 35(4), 405-426.

- (Article) Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A review and road map of entrepreneurial equity financing research: venture capital, corporate venture capital, angel investment, crowdfunding, and accelerators. Journal of Management, 43(6), 1820-1853.

- (Article) Grilli, L., & Murtinu, S. (2014). New technology-based firms in Europe: market penetration, public venture capital, and timing of investment. Industrial and Corporate Change, 24(5), 1109-1148.

- (Article) Harrison, R. (2013). Crowdfunding and the revitalisation of the early stage risk capital market: catalyst or chimera?; Venture Capital, 15(4), 283-287.

- (Article) Hsu, D. K., Haynie, J. M., Simmons, S. A., & McKelvie, A. (2014). What matters, matters differently: a conjoint analysis of the decision policies of angel and venture capital investors. Venture Capital, 16(1), 1-25.

- (Article) Kerr, W. R., Lerner, J., & Schoar, A. (2014). The consequences of entrepreneurial finance: Evidence from angel financings. The Review of Financial Studies, 27(1), 20-55.

- (Article) Kotha, R., & George, G. (2012). Friends, family, or fools: Entrepreneur experience and its implications for equity distribution and resource mobilization. Journal of Business Venturing, 27(5), 525-543.

- (Article) Maxwell, A.L., Jeffrey, S.A., & Lévesque, M. (2011). Business angel early stage decision making. Journal of Business Venturing, 26(2), 212-225.

- (Article) Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1-16.

- (Article) Oo, P. P., Allison, T. H., Sahaym, A., & Juasrikul, S. (2019). User entrepreneurs’ multiple identities and crowdfunding performance: Effects through product innovativeness, perceived passion, and need similarity. Journal of Business Venturing, 34(5), 105895.

- (Article) Pahnke, E. C., Katila, R., & Eisenhardt, K. M. (2015). Who takes you to the dance? How partners’ institutional logics influence innovation in young firms. Administrative Science Quarterly, 60(4), 596-633.

- (Article) Park, H. D., & Steensma, H. K. (2012). When does corporate venture capital add value for new ventures?. Strategic Management Journal, 33(1), 1-22.

- (Article) Paul, S., Whittam, G., & Wyper, J. (2007). Towards a model of the business angel investment process. Venture Capital, 9(2), 107-125.

- (Article) Politis, D. (2008). Business angels and value added: what do we know and where do we go?. Venture Capital, 10(2), 127-147.

- (Article) Shane, S., & Cable, D. (2002). Network ties, reputation, and the financing of new ventures. Management Science, 48(3), 364-381.

- (Article) Sonne, L. (2012). Innovative initiatives supporting inclusive innovation in India: Social business incubation and micro venture capital. Technological Forecasting and Social Change, 79(4), 638-647.

- (Article) Steier, L., & Greenwood, R. (2000). Entrepreneurship and the evolution of angel financial networks. Organization Studies, 21(1), 163-192.

- (Article) Stevenson, R. M., Kuratko, D. F., & Eutsler, J. (2019). Unleashing main street entrepreneurship: Crowdfunding, venture capital, and the democratization of new venture investments. Small Business Economics, 52(2), 375-393.

- (Article) Van Osnabrugge, M. (2000). A comparison of business angel and venture capitalist investment procedures: an agency theory-based analysis. Venture Capital: An International Journal of Entrepreneurial Finance, 2(2), 91-109.

- (Article) Viotto da Cruz, J. (2018). Beyond financing: crowdfunding as an informational mechanism. Journal of Business Venturing, 33(3), 371-393

- (Article) Walthoff-Borm, X., Schwienbacher, A. & Vanacker, T. (2018). Equity crowdfunding: First resort or last resort?, Journal of Business Venturing, 33(4), 513-533,

- (Article) Warnick, B. J., Murnieks, C. Y., McMullen, J. S., & Brooks, W. T. (2018). Passion for entrepreneurship or passion for the product? A conjoint analysis of angel and VC decision-making. Journal of Business Venturing, 33(3), 315-332.

Professional innovation investors: Venture Capitalists

Keywords: bargaining, deal making, due diligence, syndication, venture capital

- (Book) Gompers, Paul Alan, and Joshua Lerner. The venture capital cycle. MIT press, 2004.

- (Book) Landström, H. (Ed.) Handbook of Research on Venture Capital (2007),. Cheltenham, UK: Edward Elgar Publishing Ltd.,

- (Video) Inside the mind of a venture capitalist McKinsey Global Institute

- (Article) Amit, Raphael, James Brander, and Christoph Zott. “Why do venture capital firms exist? Theory and Canadian evidence.” Journal of Business Venturing 13.6 (1998): 441-466.

- (Article) Bottazzi, L., Da Rin, M., & Hellmann, T. (2008). Who are the active investors?: Evidence from venture capital. Journal of Financial Economics, 89(3), 488-512.

- (Article) Brander, James A., Raphael Amit, and Werner Antweiler. “Venture‐capital syndication: Improved venture selection vs. the value‐added hypothesis.” Journal of Economics & Management Strategy 11.3 (2002): 423-452.

- (Article) Bygrave, William D. “Syndicated investments by venture capital firms: A networking perspective.” Journal of Business Venturing 2.2 (1987): 139-154.

- (Article) Bygrave, William D. “The structure of the investment networks of venture capital firms.” Journal of Business Venturing 3.2 (1988): 137-157.

- (Article) Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of startup firms. Journal of Business Benturing, 18(6), 689-708.

- (Article) De Clercq, D., Fried, V.H., Lehtonen, O., & Sapienza, H.J. (2006). An entrepreneur’s guide to the venture capital galaxy. The Academy of Management Perspectives, 20(3), 90-112.

- (Article) Dimov, D., & De Clercq, D. (2006). Venture capital investment strategy and portfolio failure rate: A longitudinal study. Entrepreneurship Theory and Practice, 30(2), 207-223.

- (Article) Dimov, D., & Milanov, H. (2010). The interplay of need and opportunity in venture capital investment syndication. Journal of Business Venturing, 25(4), 331-348.

- (Article) Gompers, P., & Lerner, J. (2001). The venture capital revolution. Journal of Economic Perspectives, 15(2), 145-168.

- (Article) Gorman, Michael, and William A. Sahlman. “What do venture capitalists do?.” Journal of Business Venturing 4.4 (1989): 231-248.

- (Article) Hellmann, T., & Puri, M. (2000). The interaction between product market and financing strategy: The role of venture capital. The Review of Financial Studies, 13(4), 959-984.

- (Article) Hellmann, T., & Puri, M. (2002). Venture capital and the professionalization of start‐up firms: Empirical evidence. The Journal of Finance, 57(1), 169-197.

- (Article) Hsu, D. H. (2004). What do entrepreneurs pay for venture capital affiliation?. The Journal of Finance, 59(4), 1805-1844.

- (Article) Hsu, D. H. (2006). Venture capitalists and cooperative start-up commercialization strategy. Management Science, 52(2), 204-219.

- (Article) Jääskeläinen, M., Maula, M., & Murray, G. (2007). Profit distribution and compensation structures in publicly and privately funded hybrid venture capital funds. Research Policy, 36(7), 913-929.

- (Article) Kaplan, S. N., & Strömberg, P. (2003). Financial contracting theory meets the real world: An empirical analysis of venture capital contracts. The Review of Economic Studies, 70(2), 281-315.

- (Article) Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. RAND Journal of Economics, 674-692.

- (Article) Manigart, S., Lockett, A., Meuleman, M., Wright, M., Landström, H., Bruining, H., & Hommel, U. (2006). Venture capitalists’ decision to syndicate. Entrepreneurship Theory and Practice, 30(2), 131-153.

- (Article) Sahlman, W. A. (1990). The structure and governance of venture-capital organizations. Journal of Financial Economics, 27(2), 473-521.

- (Article) Sapienza, Harry J. “When do venture capitalists add value?.” Journal of Business Venturing 7.1 (1992): 9-27.

- (Article) Shepherd, D. A., Ettenson, R., & Crouch, A. (2000). New venture strategy and profitability: A venture capitalist’s assessment. Journal of Business Venturing, 15(5-6), 449-467.

- (Article) Sorenson, Olav, and Toby E. Stuart. “Syndication networks and the spatial distribution of venture capital investments 1.” American Journal of Sociology 106.6 (2001): 1546-1588.

(c) Prof. Benoit Gailly, Louvain School of Management