(This article, co-authored by Paul Belleflamme, Nessrine Omrani and Martin Peitz, has been published in the CESIfo DICE Report of June 2016, which also presents five other articles on crowdfunding.)

Crowdfunding can be seen as an open call made through the Internet to provide financial resources to support new ventures. Several forms of crowdfunding coexist, which mainly differ by the type of compensation that they propose to funders. Compensations can be monetary or not. In the former case, funders are investors and may be offered equity stakes (‘crowdinvesting’), interest payments (‘crowdlending’), or a fraction of profits (‘royalty-based crowdfunding’). In the latter case, funders are consumers or donors and may be offered a product in pre-sale, combined with some perks (‘reward-based crowdfunding’), or some warm glow (‘donation-based crowdfunding’).

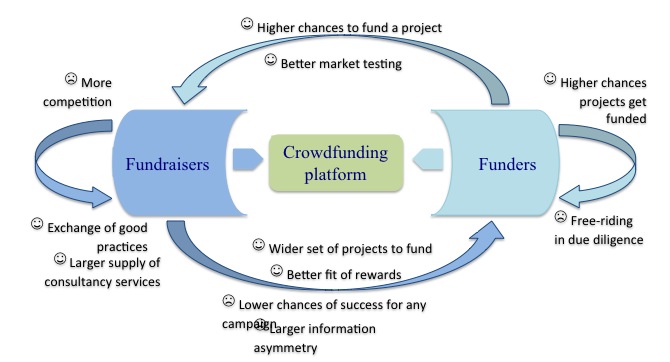

Whatever its form, crowdfunding mostly takes place on crowdfunding platforms (CFPs). Our objective in this article is twofold: we want to show why and how CFPs facilitate the interaction between entrepreneurs trying to raise funds (the ‘fundraisers’) and consumers/investors willing to participate in the financing of new projects (the ‘funders’). The ‘why’ has to do with the external effects that crowdfunding generates, not only across the groups of funders and fundraisers, but also within each of these groups; we argue that the complexity of these effects is much more efficiently dealt with by a CFP than through bilateral relationships between funders and fundraisers. As for the ‘how’, we present the strategies that CFPs put in place to address the problems raised by the various external effects.

Crowdfunding and external effects

CFPs can be seen as ‘two-sided platforms’: they enable the interaction between two ‘sides’ (here, fundraisers and funders) whose demands need to be coordinated. The open and large-scale nature of crowdfunding explains why an intermediary (i.e., a CFP) can achieve this coordination more efficiently – i.e., at lower transaction costs – than the members of the two sides by themselves. The transaction costs stem from the presence of external effects across the two groups: the value that each group attaches to the interaction depends on the participation of the other group. Typically, the more funders participate the more crowdfunding becomes attractive for fundraisers, and vice versa. We expect thus these so-called ‘cross-group external effects’ to be positive on both sides; we also expect CFPs to manage these external effects by choosing an appropriate price structure for the access and participation on the platform by the two groups.

As we now show, things are slightly more complex. First, some cross-group external effects may be negative. Second, there also exist ‘within-group external effects’, according to which the value that a user attaches to the interaction with the other group also depends on the participation within this user’s own group. Finally, CFPs also use a wide array of non-price strategies to manage the various external effects.

Cross-group external effects on CFPs

Cross-group external effects arise when one group’s valuation of the platform depends on the participation of the other group. Let us first examine the impacts of funders’ participation on fundraisers. These effects are positive without any ambiguity. A platform that attracts a larger pool of potential funders benefits fundraisers in two ways. First, and quite obviously, the presence of a larger crowd of funders increases any fundraiser’s chance to finance their project. Second, entrepreneurs often use CFPs as marketing channels to evaluate (and possibly stimulate) the demand for their product. (The fact that large companies, which have an easy access to capital markets, use CFPs is an indirect proof that crowdfunding is not just about funding. For instance, Sony has launched a CFP, First Flight, to test the popularity–rather than to finance–its own new products.) Again, the larger the crowd of consumers/investors, the more efficient this market testing can be. Yet, to the extent that fundraisers use a project on a CFP as part of a price discrimination strategy, they may not always be interested in an expansion of the pool of funders. A necessary condition for this to happen is that not only the size but also the composition of the group of funders on a CFP will have to change.

As for the impacts of fundraisers’ participation on funders, it seems at first glance that they are positive as well. We can indeed see two reasons why funders are likely to prefer platforms with a larger number of fundraisers: first, platforms with more fundraisers provide funders with a wider choice of projects to fund; second, when compensations are non-monetary, funders are more likely to obtain rewards that fit their tastes on platforms that attract many fundraisers. One can think, however, of a couple of mitigating factors. First, a larger number of campaigns on a platform could reduce the chance that any of them would be successful (i.e., would reach the required threshold), which would affect funders negatively. Yet, as such risk results from coordination failures among funders, CFPs can neutralize it by guiding interested funders to campaigns that are close to become a success. A second negative cross-group external effect would arise if asymmetric information problems became more serious as the number of fundraisers on a platform grows larger. As discussed below, information asymmetries cause two types of issues for funders on CFPs: funders may not only lack the necessary information to assess the chances of success of the proposed campaigns, and they may also not be able to control how fundraisers use the funds that they have collected. Whether these problems are more acute (or the cost for funders and platforms to alleviate these problems are larger) on platforms with more fundraisers is an empirical question.

Within-group external effects on CFPs

Fundraisers and funders also care about the participation on the platform of the members of their own group. Within the group of fundraisers, external effects are mostly negative: as fundraisers compete for funders’ contributions, the more campaigns a platform hosts, the tougher the competition. However, a larger pool of fellow fundraisers may favor the exchange of good practices among them, or may attract a larger supply of consultancy services adapted to crowdfunding. This suggests that external effects may sometimes be positive within the group of fundraisers. (Strictly speaking, there are positive feedback effects between fundraisers and CFP-specific providers of consulting service who constitute a third side of the platform.)

Within the group of funders, external effects can be expected to be positive. This is certainly so if a project needs to reach a pre-specified threshold of financing to be carried out. This is known as the ‘threshold-pledge’ or ‘All-or-Nothing’ (AON) model (an alternative is the ‘flexible funding’ or ‘Keep-it-all’ (KIA) model, which allows a fundraiser to collect any funds raised even when the target is not reached). In this case, the presence of additional funders on a platform increases the probability that any project will be realized, which benefits all funders.

Other external effects may also come into play within the group of funders. They result from the sequential process that funding follows on CFPs, which induces a form of dynamic behavior among funders. We have already mentioned that asymmetries of information prevail on CFPs as, typically, funders have little information about the reliability of fundraisers and the quality of their projects. Because funding is sequential, funders may try to infer information from the behavior of fellow funders (even if those do not possess better information to start with). In particular, funders may rely on the existing support for a given project to gauge its potential, thereby creating a type of peer-effect known as ‘collective attention effect’. The sign of this effect – i.e., whether it ultimately benefits or harms funders – depends on the first funders. For instance, if the first funders had poor information or made a bad decision, herding will lead subsequent funders to back the wrong horse. There are reasons to believe that this scenario is relevant in practice, as funders lack the capabilities and the incentive to devote the appropriate resources to due diligence. There is thus a ‘collective-action problem’ in that funders naturally tend to free ride on fellow funders to collect information about the fundraisers’ chances of success. Finally, another form of free-riding may create a negative external effect: in the AON model, when the financing of a project comes close to the threshold, it may become harder to induce funders to provide the remaining financing as they may rely on other funders to do it.

Figure 1 summarizes the various cross-group and within-group external effects that crowdfunding generates.

Strategies of CFPs

The presence of strong and intertwined cross-group and within-group external effects in crowdfunding limits the ability of fundraisers and funders to conduct transactions bilaterally in an efficient way. This creates business opportunities for intermediation, which CFPs try to seize by designing adequate strategies. These strategies aim at creating value for the two groups by driving agents to ‘internalize’ (i.e., to integrate into their decision-making process) the effects that their actions have across or within their group. Naturally, to achieve a profitable business model, CFPs must find ways to capture a sufficient share of the value that they create for their users. We consider in turn price and non-price strategies

Price strategies

Currently, most CFPs charge only one group or impose a “tax” on a successful transaction. The common practice is to charge a transaction fee to fundraisers as a percent basis for all successful campaigns (unsuccessful campaigns are generally not taxed). As for funders, they usually do not pay any explicit fee. Yet, insofar as time elapses between the moment funders contribute money and the moment this money is either passed on to fundraisers (when the campaign is successful) or returned to the funders (otherwise), funders incur a foregone interest when investing (early) in a project, which can be seen as an implicit fee.

This reliance on transaction fees is common on two-sided platforms, especially in new markets where participants have little understanding of the value they attach to the interaction with the other group(s). The reason is that imposing subscription fees may scare participants away, which would jeopardize the launch of the platform. Pushing this logic one step further, participation may even be subsidized for some participants, especially in the early life of the platform. For instance, it is not rare that CFPs do not wait for fundraisers to join the platform but actively seek for the most interesting of them and later, facilitate their campaigns on the platform.

On top of the tax levied on transactions, CFPs usually have two other sources of revenues. First, as just explained, they earn interest on the money pledged by funders; second, they may also offer additional paying services to the two groups; for instance, CFPs may charge for handling payments, for supporting projects, or for releasing information on previous projects.

Non-price strategies

CFPs also use non-price strategies to manage cross-group external effects. First and foremost, CFPs have to choose a mechanism for raising funds. As described above, the choice is primarily between the ‘All-or-Nothing’ (AON) and ‘Keep-it-all’ (KIA) mechanisms. In the AON model, fundraisers have first to specify a target, knowing that they will not receive any of the money that has been pledged if this target is not reached. Although this mechanism may not seem terribly attractive for fundraisers (compared to the KIA model where any money pledged can be kept), it has the advantage to protect funders as it drives fundraisers to set realistic funding targets that match more closely the funding that they need to achieve their project. As cross-group external effects from funders to fundraisers are generally positive, choosing the AON mechanism to reassure funders is an indirect way to make the platform more attractive for fundraisers.

Another indirect advantage of the AON model for fundraisers is that it makes some funders ‘pivotal’ insofar as it is their contribution that makes total funding reach the target. This is especially important in the context of reward-based crowdfunding, where funders receive the project’s product as compensation for their funding. Fundraisers are then in a position to raise their profits by charging different prices for their product to consumers/investors who are pivotal and to those who are not.

This being said, fundraisers may prefer the flexibility of the KIA model (even though CFPs usually charge higher fees on funds that fundraisers keep when the target is not reached). If so, choosing AON would discourage fundraisers to join the platform and, through cross-group external effects, would discourage funders as well. An alternative is to propose both models and let fundraisers choose. A benefit of this solution is that funders now have the possibility to make inferences from the fundraisers’ choices: it is indeed documented that by choosing AON, fundraisers credibly signal to funders that they commit not to undertake their project if they do not reach the target; funders can then see the investment in such projects as less “risky”, which allows fundraisers to increase their chances of success. The choice between AON and KIA should be largely driven by how the benefit from a project depends on the funding level. If the use of funds below the threshold level is highly inefficient AON should be the preferred funding format.

Apart from managing cross-group effects, CFPs also design specific strategies to address asymmetric information problems (acknowledging, as we have just seen, that some strategies address the two issues at once). We can distinguish between two generic types of problems: hidden information problems (funders often lack the necessary information to estimate the chances of success of the proposed campaigns) and hidden action problems (funders have a hard time to control how fundraisers use the collected funds).

A first instrument in mitigating hidden information problems is direct screening: CFPs conduct due diligence themselves and reject projects that are deemed too risky. Alternatively (or complementarily), CFPs may provide funders with a market-based screening mechanism; for instance, some crowdlending platforms give funders access to ‘soft’ information about fundraisers (such as the maximum interest rate they are willing to pay, a textual description of their reasons for the loan application, or their picture). Studies show that funders can predict default with more precision on the basis of such nonstandard information than with the use of more traditional screening methods based on credit score. Finally, CFPs may also bring sophisticated investors on board the platform. This may include institutional investors, venture capitalists, or business angels, that have much larger capacities and experience in due diligence. Their presence is thus likely to reassure funders, as more information will be made available about the chances of success of the proposed campaigns.

As for hidden action problems (a.k.a. moral hazard), a first immediate measure is to invest in an adequate monitoring system so as to avoid – or at least limit – severe opportunism problems by fundraisers, such as outright fraud. In the same vein, CFPs can prevent fundraisers to use the arriving funds before the success of a campaign is assured by taking control of making the financial transaction. Another strategy is to install a reputation system. Naturally, such a system can only work if fundraisers repeatedly use a given CFP and have some persistent abilities. Then, the CFP can use the track record of a given fundraiser to provide funders with useful information about this fundraiser’s reliability. To enrich this reputation system, the CFP can also tap into the wealth of information available on social networks; it has indeed been documented that the number of friends that fundraisers have on Facebook can be used as a predictor of the success of their projects. Finally, CFPs may also find ways to insure funders against a number of risks; for instance, some crowdlending platforms choose to partner with banks to insure against market risks.

Conclusion

Our goal in this article was to show that crowdfunding platforms are at the heart of the current development of the different forms of crowdfunding. Without the intermediation services that these platforms provide, fundraisers and funders would not be able to interact in an efficient way. To make our point, we have described the ‘why’ (i.e., the complex web of external effects that crowdfunding generates for funders and fundraisers), as well as the ‘how’ (the price and non-price strategies that platforms deploy to address these external effects).

Even if crowdfunding is still nascent and is thus bound to evolve, we believe that the framework of analysis that we propose here will remain relevant and help us comprehend future developments.

(All photos via Visualhunt.com; credits to: Qaanaaq / Victoria Reay / edans)