Probably the most important but least understood aspect of a successful innovative business model is the identification and mobilization of the required entrepreneurial talent and expertise. Too often firms decide first to launch a project and then try to staff and link it with whoever is available, that is in many cases not the right people or partners.

Probably the most important but least understood aspect of a successful innovative business model is the identification and mobilization of the required entrepreneurial talent and expertise. Too often firms decide first to launch a project and then try to staff and link it with whoever is available, that is in many cases not the right people or partners.

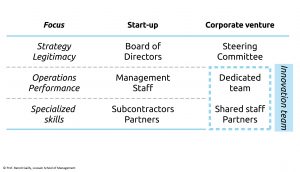

The hidden secret behind the failures of many innovative ventures is not bad technologies but bad governance, with the wrong people taking the wrong decisions or failing to take any decisions at all.

The hidden secret behind the failures of many innovative ventures is not bad technologies but bad governance, with the wrong people taking the wrong decisions or failing to take any decisions at all.

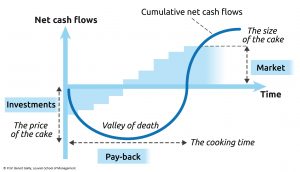

The easiest way to waste an innovation opportunity is to underestimate the financial resources required over time to support the launch and growth of a sustainable business model. Great innovations are never overnight successes.

The easiest way to waste an innovation opportunity is to underestimate the financial resources required over time to support the launch and growth of a sustainable business model. Great innovations are never overnight successes.

Bibliography

Entrepreneurial talent and expertise: Who does what?

Keywords: make or buy, scalability, entrepreneurial team, human capital, human resources, venture team

- (Book) Becker, Gary S. “Human capital revisited.” In Human Capital: A Theoretical and Empirical Analysis with Special Reference to Education (3rd Edition). The University of Chicago Press, 1994. 15-28.

- (Book) Berlin, L. (2017). Troublemakers: Silicon Valley’s Coming of Age. Simon and Schuster.

- (Book) Ensley, M. D. (2014). Entrepreneurial Teams as Determinants of of New Venture Performance. Routledge.

- (Book) Steve Jobs by Walter Isaacson

- (Book) Ismail, S. (2014). Exponential Organizations: Why new organizations are ten times better, faster, and cheaper than yours (and what to do about it). Diversion Books.

- (Video) How Google builds the perfect team

- (Article) Allee, V. (2000). Reconfiguring the value network. Journal of Business Strategy, 21(4), 36-39.

- (Article) Azoulay, P., Stuart, T., & Wang, Y. (2014). Matthew: Effect or fable?. Management Science, 60(1), 92-109.

- (Article) Baron, J. N., Burton, M. D., & Hannan, M. T. (1996). The road taken: Origins and evolution of employment systems in emerging companies. Industrial and Corporate Change, 5(2), 239-275.

- (Article) Baum, J. A., Calabrese, T., & Silverman, B. S. (2000). Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal, 267-294.

- (Article) Bosma, N., Van Praag, M., Thurik, R., & De Wit, G. (2004). The value of human and social capital investments for the business performance of startups. Small Business Economics, 23, 227-236.

- (Article) Brinckmann, J., & Hoegl, M. (2011). Effects of initial teamwork capability and initial relational capability on the development of new technology‐based firms. Strategic Entrepreneurship Journal, 5(1), 37-57.

- (Article) Brüderl, J., Preisendörfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 227-242.

- (Article) Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded business. Small Business Economics, 10(3), 213-225.

- (Article) Clarysse, B., & Moray, N. (2004). A process study of entrepreneurial team formation: the case of a research-based spin-off. Journal of Business Venturing, 19(1), 55-79.

- (Article) Crook, T. R., Todd, S. Y., Combs, J. G., Woehr, D. J., & Ketchen Jr, D. J. (2011). Does human capital matter? A meta-analysis of the relationship between human capital and firm performance. Journal of Applied Psychology, 96(3), 443.

- (Article) Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301-331.

- (Article) De Bettignies, J. E., & Chemla, G. (2008). Corporate venturing, allocation of talent, and competition for star managers. Management Science, 54(3), 505-521.

- (Article) Deeds, D. L., DeCarolis, D., & Coombs, J. (2000). Dynamic capabilities and new product development in high technology ventures: An empirical analysis of new biotechnology firms. Journal of Business Venturing, 15(3), 211-229.

- (Article) Eesley, C. E., Hsu, D. H., & Roberts, E. B. (2014). The contingent effects of top management teams on venture performance: Aligning founding team composition with innovation strategy and commercialization environment. Strategic Management Journal, 35(12), 1798-1817.

- (Article) Eikebrokk, T. R., & Olsen, D. H. (2007). An empirical investigation of competency factors affecting e-business success in European SMEs. Information & Management, 44(4), 364-383.

- (Article) Ensley, M. D., Pearson, A. W., & Amason, A. C. (2002). Understanding the dynamics of new venture top management teams: cohesion, conflict, and new venture performance. Journal of Business Venturing, 17(4), 365-386.

- (Article) Ensley, M. D., & Hmieleski, K. M. (2005). A comparative study of new venture top management team composition, dynamics and performance between university-based and independent start-ups. Research Policy, 34(7), 1091-1105.

- (Article) Ernst, H., & Vitt, J. (2000). The influence of corporate acquisitions on the behaviour of key inventors. R&D Management, 30(2), 105-120.

- (Article) Fonseca, T., de Faria, P., & Lima, F. (2019). Human capital and innovation: the importance of the optimal organizational task structure. Research Policy, 48(3), 616-627.

- (Article) Franke, N., Gruber, M., Harhoff, D., & Henkel, J. (2008). Venture Capitalists’ Evaluations of Start‐Up Teams: Trade‐Offs, Knock‐Out Criteria, and the Impact of VC Experience. Entrepreneurship Theory and Practice, 32(3), 459-483.

- (Article) Gemünden, H. G., Salomo, S., & Hölzle, K. (2007). Role models for radical innovations in times of open innovation. Creativity and Innovation Management, 16(4), 408-421.

- (Article) Henneke, D., & Lüthje, C. (2007). Interdisciplinary heterogeneity as a catalyst for product innovativeness of entrepreneurial teams. Creativity and Innovation Management, 16(2), 121-132.

- (Article) Herron, L., & Robinson Jr, R. B. (1993). A structural model of the effects of entrepreneurial characteristics on venture performance. Journal of Business Venturing, 8(3), 281-294.

- (Article) Higgins, M. J., Stephan, P. E., & Thursby, J. G. (2011). Conveying quality and value in emerging industries: Star scientists and the role of signals in biotechnology. Research Policy, 40(4), 605-617.

- (Article) Hoecht, A., & Trott, P. (2006). Innovation risks of strategic outsourcing. Technovation, 26(5-6), 672-681.

- (Article) Hoenig, D., & Henkel, J. (2015). Quality signals? The role of patents, alliances, and team experience in venture capital financing. Research Policy, 44(5), 1049-1064.

- (Article) Hsu, D. H. (2007). Experienced entrepreneurial founders, organizational capital, and venture capital funding. Research Policy, 36(5), 722-741.

- (Article) Ko,, E. & McKelvie, A. (2018). Signaling for more money: The roles of founders’ human capital and investor prominence in resource acquisition across different stages of firm development, Journal of Business Venturing, 33(4), 438-454,

- (Article) Lazar, M., Miron-Spektor, E., Agarwal, R., Erez, M., Goldfarb, B., & Chen, G. (2020). Entrepreneurial team formation. Academy of Management Annals, 14(1), 29-59.

- (Article) Lechler, T. (2001). Social interaction: A determinant of entrepreneurial team venture success. Small Business Economics, 16(4), 263-278.

- (Article) Marvel, M. R., Davis, J. L., & Sproul, C. R. (2016). Human capital and entrepreneurship research: A critical review and future directions. Entrepreneurship Theory and Practice, 40(3), 599-626.

- (Article) McGuirk, H., Lenihan, H., & Hart, M. (2015). Measuring the impact of innovative human capital on small firms’ propensity to innovate. Research Policy, 44(4), 965-976.

- (Article) Mitteness, C. R., Baucus, M. S., & Sudek, R. (2012). Horse vs. jockey? How stage of funding process and industry experience affect the evaluations of angel investors. Venture Capital, 14(4), 241-267.

- (Article) Mosey, S., & Wright, M. (2007). From human capital to social capital: A longitudinal study of technology‐based academic entrepreneurs. Entrepreneurship Theory and Practice, 31(6), 909-935.

- (Article) Nuscheler, D., Engelen, A., & Zahra, S. A. (2019). The role of top management teams in transforming technology-based new ventures’ product introductions into growth. Journal of Business Venturing. 34(1), 122-140

- (Article) Partanen, J., Chetty, S. K., & Rajala, A. (2014). Innovation types and network relationships. Entrepreneurship Theory and Practice, 38(5), 1027-1055.

- (Article) Patzelt, H., Zu Knyphausen‐Aufseß, D., & Nikol, P. (2008). Top management teams, business models, and performance of biotechnology ventures: An upper echelon perspective. British Journal of Management, 19(3), 205-221.

- (Article) Pennings, J. M., Lee, K., & Witteloostuijn, A. V. (1998). Human capital, social capital, and firm dissolution. Academy of Management Journal, 41(4), 425-440.

- (Article) Samuelsson, M., & Davidsson, P. (2009). Does venture opportunity variation matter? Investigating systematic process differences between innovative and imitative new ventures. Small Business Economics, 33(2), 229-255

- (Article) Shane, S., & Stuart, T. (2002). Organizational endowments and the performance of university start-ups. Management Science, 48(1), 154-170.

- (Article) Shrader, R., & Siegel, D. S. (2007). Assessing the Relationship between Human Capital and Firm Performance: Evidence from Technology–Based New Ventures. Entrepreneurship Theory and Practice, 31(6), 893-908.

- (Article) Tidd, J. (2014). Conjoint innovation: Building a bridge between innovation and entrepreneurship. International Journal of Innovation Management, 18(01), 1450001.

- (Article) Unger, J.M., Rauch, A., Frese, M. & Rosenbuch, N. (2011). Human capital and entrepreneurial success: A meta-analytical review. Journal of Business Venturing, 26(3), 341-358

- (Article) Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46(4), 579-590.

- (Article) Wang, H. C., He, J., & Mahoney, J. T. (2009). Firm‐specific knowledge resources and competitive advantage: the roles of economic‐and relationship‐based employee governance mechanisms. Strategic Management Journal, 30(12), 1265-1285.

- (Article) Zhang, L. (2019). Founders matter! Serial entrepreneurs and venture capital syndicate formation. Entrepreneurship Theory and Practice, 43(5), 974-998

Governance: Who decides what?

Keywords: board, corporate governance, governance, organizational structure, upper echelon

- (Book) Charan, R., Barton, D., & Carey, D. (2018). Talent Wins: The New Playbook for Putting People First. Harvard Business Press.

- (Book) Finkelstein, S. (2004). Why smart executives fail: And what you can learn from their mistakes. Penguin.

- (Book) Govindarajan, V., & Trimble, C. (2010). The other side of innovation: Solving the execution challenge. Harvard Business Press.

- (Book) Kuratko et al. (2011) Corporate Innovation and Entrepreneurship, South-Western Cengage Learning

- (Video) Holacracy: A Radical New Approach to Management, by Brian Robertson, TEDxGrandRapids

- (Article) Anderson, S.W., & Dekker, H.C. (2005). Management control for market transactions: The relation between transaction characteristics, incomplete contract design, and subsequent performance. Management Science, 51(12), 1734-1752.

- (Article) Andries, P., & Czarnitzki, D. (2014). Small firm innovation performance and employee involvement. Small Business Economics, 43(1), 21-38.

- (Article) Ardichvili, A., Harmon, B., Cardozo, R. N., Reynolds, P. D., & Williams, M. L. (1998). The new venture growth: Functional differentiation and the need for human resource development interventions. Human Resource Development Quarterly, 9(1), 55-70.

- (Article) Arzubiaga, U., Kotlar, J. De Massis, A., Maseda, A. & Iturralde, T. (2018)). Entrepreneurial orientation and innovation in family SMEs: Unveiling the (actual) impact of the Board of Directors, Journal of Business Venturing, 33(4), 455-469

- (Article) Baron, J. N., Hannan, M. T., & Burton, M. D. (1999). Building the iron cage: Determinants of managerial intensity in the early years of organizations. American Sociological Review, 527-547.

- (Article) Cardon, M. S., & Stevens, C. E. (2004). Managing human resources in small organizations: What do we know?. Human Resource Management Review, 14(3), 295-323.

- (Article) Clarysse, B., Knockaert, M., & Lockett, A. (2007). Outside board members in high tech start-ups. Small Business Economics, 29(3), 243-259.

- (Article) Colombo, M. G., Croce, A., & Murtinu, S. (2014). Ownership structure, horizontal agency costs and the performance of high-tech entrepreneurial firms. Small Business Economics, 42(2), 265-282.

- (Article) Daily, C. M., & Dalton, D. R. (1992). The relationship between governance structure and corporate performance in entrepreneurial firms. Journal of Business Venturing, 7(5), 375-386.

- (Article) Daily, C. M., Dalton, D. R., & Cannella Jr, A. A. (2003). Corporate governance: Decades of dialogue and data. Academy of Management Review, 28(3), 371-382.

- (Article) Forbes, Daniel P., and Frances J. Milliken. “Cognition and corporate governance: Understanding boards of directors as strategic decision-making groups.” Academy of Management Review 24.3 (1999): 489-505

- (Article) Fried, V. H., Bruton, G. D., & Hisrich, R. D. (1998). Strategy and the board of directors in venture capital-backed firms. Journal of Business Venturing, 13(6), 493-503.

- (Article) Garg, S., & Furr, N. (2017). Venture Boards: Past Insights and Future Directions. Strategic Entrepreneurship Journal. 11, 326–343.

- (Article) Greinier, L.E. (1998) Evolution and Revolution as Organizations Grow. Harvard Business Review, reprint 98308

- (Article) Gulati, R., Puranam, P., & Tushman, M. (2012). Meta‐organization design: Rethinking design in interorganizational and community contexts. Strategic Management Journal, 33(6), 571-586.

- (Article) Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of Management Review, 32(2), 334-343.

- (Article) Hillman, A. J., & Dalziel, T. (2003). Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Academy of Management Review, 28(3), 383-396.

- (Article) Hotho, S., & Champion, K. (2011). Small businesses in the new creative industries: innovation as a people management challenge. Management Decision, 49(1), 29-54.

- (Article) Kor, Y. Y., & Mesko, A. (2013). Dynamic managerial capabilities: Configuration and orchestration of top executives’ capabilities and the firm’s dominant logic. Strategic Management Journal, 34(2), 233-244.

- (Article) Kor, Y. Y., & Misangyi, V. F. (2008). Outside directors’ industry‐specific experience and firms’ liability of newness. Strategic Management Journal, 29(12), 1345-1355.

- (Article) McDonald, M. L., Khanna, P., & Westphal, J. D. (2008). Getting them to think outside the circle: Corporate governance, CEOs’ external advice networks, and firm performance. Academy of Management Journal, 51(3), 453-475.

- (Article) Miles, M. P., & Covin, J. G. (2002). Exploring the practice of corporate venturing: Some common forms and their organizational implications. Entrepreneurship Theory and Practice, 26(3), 21-40

- (Article) Nieto, M. J., Santamaria, L., & Fernandez, Z. (2015). Understanding the innovation behavior of family firms. Journal of Small Business Management, 53(2), 382-399.

- (Article) Patel, P. C., & Cardon, M. S. (2010). Adopting HRM practices and their effectiveness in small firms facing product‐market competition. Human Resource Management, 49(2), 265-290.

- (Article) Phene, A., & Tallman, S. (2012). Complexity, context and governance in biotechnology alliances. Journal of International Business Studies, 43(1), 61-83.

- (Article) Prester, J., & Bozac, M. G. (2012). Are innovative organizational concepts enough for fostering innovation?. International Journal of Innovation Management, 16(01), 1250005.

- (Article) Quinn, R. E., & Cameron, K. (1983). Organizational life cycles and shifting criteria of effectiveness: Some preliminary evidence. Management Science, 29(1), 33-51.

- (Article) Sanders, W. M., & Boivie, S. (2004). Sorting things out: Valuation of new firms in uncertain markets. Strategic Management Journal, 25(2), 167-186.

- (Article) Sine, W.D., Mitsuhashi, H., & Kirsch, D.A. (2006). Revisiting Burns and Stalker: Formal structure and new venture performance in emerging economic sectors. Academy of Management Journal, 49(1), 121-132.

- (Article) Wasserman, N. (2017). The throne vs. the kingdom: Founder control and value creation in startups. Strategic Management Journal, 38(2), 255-277.

- (Article) Zahra, S. A., Neubaum, D. O., & Huse, M. (2000). Entrepreneurship in medium-size companies: Exploring the effects of ownership and governance systems. Journal of Management, 26(5), 947-976.

How much? Financial resources

Keywords: barriers to entry, break-even, cannibalization, financial metrics, payback, valley of death

- (Book) Andrew, James P., Harold L. Sirkin, and John Butman. Payback: reaping the rewards of innovation. Harvard Business Press, 2007.

- (Book) Damodaran, A. (2009). The dark side of valuation: valuing young, distressed, and complex businesses. Ft Press.

- (Video) Introduction to Valuation Aswath Damodaran

- (Article) Heirman, Ans, and Bart Clarysse. “How and why do research-based start-ups differ at founding? A resource-based configurational perspective.” The Journal of Technology Transfer 29.3 (2004): 247-268.

- (Article) Zott, C., & Amit, R. (2007). Business model design and the performance of entrepreneurial firms. Organization Science, 18(2), 181-199.

(c) Prof. Benoit Gailly, Louvain School of Management