On top of their own R&D activities and operational improvements, firms must develop the ability to proactively harvest technology (r)evolutions. They must be able to absorb technology intelligence from external sources, both in their socioeconomic ecosystem and in the wider environment.

On top of their own R&D activities and operational improvements, firms must develop the ability to proactively harvest technology (r)evolutions. They must be able to absorb technology intelligence from external sources, both in their socioeconomic ecosystem and in the wider environment.

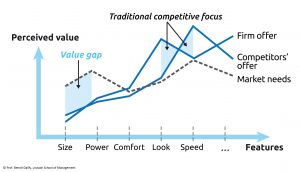

On top of their traditional marketing approaches, firms need to develop user-centric ways to “pull” untapped customer needs and uncover value gaps. They need to combine powerful analytics with in situ and empathetic observations and involvement of key users.

On top of their traditional marketing approaches, firms need to develop user-centric ways to “pull” untapped customer needs and uncover value gaps. They need to combine powerful analytics with in situ and empathetic observations and involvement of key users.

Firms should also invest time, money and resources to network and work with small innovative firms and disruptive start-ups, in particular through corporate venture capital initiatives. This should allow them to create options, leverage their assets and develop new competitive and technology intelligence.

Firms should also invest time, money and resources to network and work with small innovative firms and disruptive start-ups, in particular through corporate venture capital initiatives. This should allow them to create options, leverage their assets and develop new competitive and technology intelligence.

Bibliography

Harvest technology (r)evolutions

Keywords: absorptive capacity, biomimicry, cross-industry innovation, Delphi method, greensourcing, not-invented-here, reverse engineering, technology intelligence

- (Book) Argyris, C., & Schön, D. A. (1978). Organizational Learning, Readings. MA: Addison.

- (Video) How does nature do life-friendly chemistry? – AskNature Nugget by Biomimicry Institute (on Vimeo)

- (Article) Almeida, P., Dokko, G., & Rosenkopf, L. (2003). Startup size and the mechanisms of external learning: increasing opportunity and decreasing ability?. Research Policy, 32(2), 301-315.

- (Article) Amara, N., & Landry, R. (2005). Sources of information as determinants of novelty of innovation in manufacturing firms: evidence from the 1999 statistics Canada innovation survey. Technovation, 25(3), 245-259.

- (Article) Antons, D., & Piller, F.T. (2015). Opening the black box of “Not Invented Here”: attitudes, decision biases, and behavioral consequences. The Academy of Management Perspectives, 29(2), 193-217.

- (Article) Becker, W., & Dietz, J. (2004). R&D cooperation and innovation activities of firms—evidence for the German manufacturing industry. Research Policy, 33(2), 209-223..

- (Article) Bercovitz, J. E., & Feldman, M. P. (2007). Fishing upstream: Firm innovation strategy and university research alliances. Research Policy, 36(7), 930-948.

- (Article) Bierly III, P. E., Damanpour, F., & Santoro, M. D. (2009). The application of external knowledge: organizational conditions for exploration and exploitation. Journal of Management Studies, 46(3), 481-509.

- (Article) Bouty, I. (2000). Interpersonal and interaction influences on informal resource exchanges between R&D researchers across organizational boundaries. Academy of Management Journal, 43(1), 50-65.

- (Article) Breschi, S., & Catalini, C. (2010). Tracing the links between science and technology: An exploratory analysis of scientists’ and inventors’ networks. Research Policy, 39(1), 14-26.

- (Article) Brusoni, S., Prencipe, A., & Pavitt, K. (2001). Knowledge specialization, organizational coupling, and the boundaries of the firm: why do firms know more than they make?. Administrative Science Quarterly, 46(4), 597-621.

- (Article) Chen, C. J. (2004). The effects of knowledge attribute, alliance characteristics, and absorptive capacity on knowledge transfer performance. R&D Management, 34(3), 311-321.

- (Article) Chiesa, V., Manzini, R., & Pizzurno, E. (2004). The externalisation of R&D activities and the growing market of product development services. R&d Management, 34(1), 65-75.

- (Article) Chiu, I., & Shu, L. H. (2006). Biomimetic design through natural language analysis to facilitate cross-domain information retrieval. Artificial Intelligence for Engineering Design, Analysis and Manufacturing, 21, 45-59

- (Article) Cohen, W.M. and Levinthal, D.A. (1990). Absorptive capacity: a new perspective on learning and innovation. Administrative Science Quarterly, March 1990, 128-152

- (Article) Csete, M. E., & Doyle, J. C. (2002). Reverse engineering of biological complexity. Science, 295(5560), 1664-1669.

- (Article) Day, G. S., & Schoemaker, P. J. (2000). Avoiding the pitfalls of emerging technologies. California Management Review, 42(2), 8-33.

- (Article) De Marchi, V. (2012). Environmental innovation and R&D cooperation: Empirical evidence from Spanish manufacturing firms. Research Policy, 41(3), 614-623.

- (Article) Denicolai, S., Ramirez, M., & Tidd, J. (2014). Creating and capturing value from external knowledge: the moderating role of knowledge intensity. R&D Management, 44(3), 248-264.

- (Article) Denicolai, S., Ramirez, M., & Tidd, J. (2016). Overcoming the false dichotomy between internal R&D and external knowledge acquisition: Absorptive capacity dynamics over time. Technological Forecasting and Social Change, 104, 57-65.

- (Article) Díaz-Díaz, N. L., & de Saá Pérez, P. (2014). The interaction between external and internal knowledge sources: an open innovation view. Journal of Knowledge Management, 18(2), 430-446.

- (Article) Eggers, J. P. (2012). Falling flat: Failed technologies and investment under uncertainty. Administrative Science Quarterly, 57(1), 47-80.

- (Article) Enkel, E., & Gassmann, O. (2010). Creative imitation: exploring the case of cross‐industry innovation. R&D Management, 40(3), 256-270.

- (Article) Enkel, E., & Heil, S. (2014). Preparing for distant collaboration: Antecedents to potential absorptive capacity in cross-industry innovation. Technovation, 34(4), 242-260.

- (Article) Escribano, A., Fosfuri, A., & Tribó, J. A. (2009). Managing external knowledge flows: The moderating role of absorptive capacity. Research Policy, 38(1), 96-105.

- (Article) Fabrizio, K. R. (2009). Absorptive capacity and the search for innovation. Research Policy, 38(2), 255-267.

- (Article) Fleming, L., & Sorenson, O. (2004). Science as a map in technological search. Strategic Management Journal, 25(8‐9), 909-928.

- (Article) Foster, J. G., Rzhetsky, A., & Evans, J. A. (2015). Tradition and innovation in scientists’ research strategies. American Sociological Review, 80(5), 875-908.

- (Article) Franzoni, C., & Sauermann, H. (2014). Crowd science: The organization of scientific research in open collaborative projects. Research Policy, 43(1), 1-20.

- (Article) Garriga, H., Von Krogh, G., & Spaeth, S. (2013). How constraints and knowledge impact open innovation. Strategic Management Journal, 34(9), 1134-1144.

- (Article) Gassmann, O., Zeschky, M., Wolff, T., & Stahl, M. (2010). Crossing the industry-line: breakthrough innovation through cross-industry alliances with ‘non-suppliers’. Long Range Planning, 43(5-6), 639-654.

- (Article) Genus, A., & Coles, A. M. (2008). Rethinking the multi-level perspective of technological transitions. Research Policy, 37(9), 1436-1445.

- (Article) Goedhuys, M., & Veugelers, R. (2012). Innovation strategies, process and product innovations and growth: Firm-level evidence from Brazil. Structural change and economic dynamics, 23(4), 516-529.

- (Article) Grigoriou, K., & Rothaermel, F. T. (2017). Organizing for knowledge generation: internal knowledge networks and the contingent effect of external knowledge sourcing. Strategic Management Journal, 38(2), 395-414.

- (Article) Grimpe, C., & Kaiser, U. (2010). Balancing internal and external knowledge acquisition: the gains and pains from R&D outsourcing. Journal of Management Studies, 47(8), 1483-1509.

- (Article) Gupta, U. G., & Clarke, R. E. (1996). Theory and applications of the Delphi technique: A bibliography (1975–1994). Technological forecasting and social change, 53(2), 185-211.

- (Article) Hagedoorn, J., & Duysters, G. (2002). External sources of innovative capabilities: the preferences for strategic alliances or mergers and acquisitions. Journal of Management Studies, 39(2), 167-188.

- (Article) Herstad, S., Sandven, T., & Ebersberger, B. (2015). Recruitment, knowledge integration and modes of innovation. Research Policy, 44, 138-153.

- (Article) Hoang, H. A., & Rothaermel, F. T. (2010). Leveraging internal and external experience: exploration, exploitation, and R&D project performance. Strategic Management Journal, 31(7), 734-758.

- (Article) Holbrook, D., Cohen, W. M., Hounshell, D. A., & Klepper, S. (2000). The nature, sources, and consequences of firm differences in the early history of the semiconductor industry. Strategic Management Journal, 21(10‐11), 1017-1041.

- (Article) Hung, K. P., & Chou, C. (2013). The impact of open innovation on firm performance: The moderating effects of internal R&D and environmental turbulence. Technovation, 33(10-11), 368-380.

- (Article) Jansen, J. J., Van Den Bosch, F. A., & Volberda, H. W. (2005). Managing potential and realized absorptive capacity: how do organizational antecedents matter?. Academy of Management Journal, 48(6), 999-1015.

- (Article) Kalogerakis, K., Lüthje, C., & Herstatt, C. (2010). Developing innovations based on analogies: experience from design and engineering consultants. Journal of Product Innovation Management, 27(3), 418-436.

- (Article) Kaplan, S., & Tripsas, M. (2008). Thinking about technology: Applying a cognitive lens to technical change. Research Policy, 37(5), 790-805.

- (Article) Katz, R., & Allen, T. J. (1982). Investigating the Not Invented Here (NIH) syndrome: A look at the performance, tenure, and communication patterns of 50 R & D Project Groups. R&D Management, 12(1), 7-20

- (Article) Kaufman, A., Wood, C. H., & Theyel, G. (2000). Collaboration and technology linkages: a strategic supplier typology. Strategic Management Journal, 21(6), 649-663.

- (Article) Knoppen, D., Sáenz, M. J., & Johnston, D. A. (2011). Innovations in a relational context: Mechanisms to connect learning processes of absorptive capacity. Management Learning, 42(4), 419-438.

- (Article) Landeta, J. (2006). Current validity of the Delphi method in social sciences. Technological forecasting and social change, 73(5), 467-482.

- (Article) Lane, P. J., & Lubatkin, M. (1998). Relative absorptive capacity and interorganizational learning. Strategic Management Journal, 19(5), 461-477.

- (Article) Lane, P. J., Koka, B. R., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review, 31(4), 833-863

- (Article) Laursen, K., & Salter, A. (2006). Open for innovation: the role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2), 131-150.

- (Article) Leischnig, A., Geigenmueller, A., & Lohmann, S. (2014). On the role of alliance management capability, organizational compatibility, and interaction quality in interorganizational technology transfer. Journal of Business Research, 67(6), 1049-1057.

- (Article) Leone, M. I., & Reichstein, T. (2012). Licensing‐in fosters rapid invention! The effect of the grant‐back clause and technological unfamiliarity. Strategic Management Journal, 33(8), 965-985.

- (Article) Lewin, A. Y., Massini, S., & Peeters, C. (2011). Microfoundations of internal and external absorptive capacity routines. Organization Science, 22(1), 81-98.

- (Article) Lifshitz-Assaf, H. (2017). Dismantling Knowledge Boundaries at NASA: The Critical Role of Professional Identity in Open Innovation. Administrative Science Quarterly, 0001839217747876.

- (Article) Lin, B. W. (2003). Technology transfer as technological learning: a source of competitive advantage for firms with limited R&D resources. R&D Management, 33(3), 327-341.

- (Article) Malerba, F., & Orsenigo, L. (1996). Schumpeterian patterns of innovation are technology-specific. Research Policy, 25(3), 451-478.

- (Article) Mindruta, D. (2013). Value creation in university‐firm research collaborations: A matching approach. Strategic Management Journal, 34(6), 644-665.

- (Article) Monteiro, F., Mol, M., & Birkinshaw, J. (2017). Ready to be open? Explaining the firm level barriers to benefiting from openness to external knowledge. Long Range Planning, 50(2), 282-295.

- (Article) Mora-Valentin, E. M., Montoro-Sanchez, A., & Guerras-Martin, L. A. (2004). Determining factors in the success of R&D cooperative agreements between firms and research organizations. Research Policy, 33(1), 17-40.

- (Article) Nason, R. S., Wiklund, J., McKelvie, A., Hitt, M., & Yu, W. (2018). Orchestrating boundaries: The effect of R&D boundary permeability on new venture growth. Journal of Business Venturing. 34(1), 63-79

- (Article) Nicholls‐Nixon, C. L., & Woo, C. Y. (2003). Technology sourcing and output of established firms in a regime of encompassing technological change. Strategic Management Journal, 24(7), 651-666.

- (Article) Nobelius, D. (2004). Towards the sixth generation of R&D management. International Journal of Project Management, 22(5), 369-375.

- (Article) Noseleit, F., & de Faria, P. (2013). Complementarities of internal R&D and alliances with different partner types. Journal of Business Research, 66 (10), 2000-2006.

- (Article) Peeters, H., Callaert, J., & Van Looy, B. (2018). Do firms profit from involving academics when developing technology?. The Journal of Technology Transfer, 1-28.

- (Article) Ranft, A. L., & Lord, M. D. (2002). Acquiring new technologies and capabilities: A grounded model of acquisition implementation. Organization Science, 13(4), 420-441.

- (Article) Reichstein, T., & Salter, A. (2006). Investigating the sources of process innovation among UK manufacturing firms. Industrial and Corporate Change, 15 (4), 653-682.

- (Article) Ritter, T., & Gemünden, H. G. (2004). The impact of a company’s business strategy on its technological competence, network competence and innovation success. Journal of Business Research, 57(5), 548-556.

- (Article) Salter, A., Ter Wal, A. L., Criscuolo, P., & Alexy, O. (2015). Open for ideation: Individual‐level openness and idea generation in R&D. Journal of Product Innovation Management, 32(4), 488-504.

- (Article) Schiele, H. (2012). Accessing supplier innovation by being their preferred customer. Research-Technology Management, 55(1), 44-50.

- (Article) Schildt, H., Keil, T., & Maula, M. (2012). The temporal effects of relative and firm‐level absorptive capacity on interorganizational learning. Strategic Management Journal, 33(10), 1154-1173

- (Article) Segarra-Blasco, A., & Arauzo-Carod, J. M. (2008). Sources of innovation and industry–university interaction: Evidence from Spanish firms. Research Policy, 37(8), 1283-1295.

- (Article) Shane, S. (2001). Technology regimes and new firm formation. Management Science, 47(9), 1173-1190.

- (Article) Shibata, N., Kajikawa, Y., Takeda, Y., & Matsushima, K. (2008). Detecting emerging research fronts based on topological measures in citation networks of scientific publications. Technovation, 28(11), 758-775.

- (Article) Sood, A., James, G. M., Tellis, G. J., & Zhu, J. (2012). Predicting the path of technological innovation: SAW vs. Moore, Bass, Gompertz, and Kryder. Marketing Science, 31(6), 964-979.

- (Article) Souitaris, V. (2002). Technological trajectories as moderators of firm-level determinants of innovation. Research Policy, 31(6), 877-898.

- (Article) Spencer, J. W. (2003). Firms’ knowledge‐sharing strategies in the global innovation system: empirical evidence from the flat panel display industry. Strategic management journal, 24(3), 217-233.

- (Article) Spithoven, A., Clarysse, B., & Knockaert, M. (2010). Building absorptive capacity to organise inbound open innovation in traditional industries. Technovation, 30(2), 130-141.

- (Article) Stock, G. N., Greis, N. P., & Fischer, W. A. (2001). Absorptive capacity and new product development. The Journal of High Technology Management Research, 12(1), 77-91.

- (Article) Tether, B. S., & Tajar, A. (2008). Beyond industry–university links: Sourcing knowledge for innovation from consultants, private research organisations and the public science-base. Research Policy, 37(6-7), 1079-1095.

- (Article) Tidd, J., & Trewhella, M. J. (1997). Organizational and technological antecedents for knowledge acquisition and learning. R&D Management, 27(4), 359-375.

- (Article) Todorova, G., & Durisin, B. (2007). Absorptive capacity: Valuing a reconceptualization. Academy of Management Review, 32(3), 774-786.

- (Article) Tsai, K. H., & Wang, J. C. (2009). External technology sourcing and innovation performance in LMT sectors: An analysis based on the Taiwanese Technological Innovation Survey. Research Policy, 38(3), 518-526.

- (Article) Un, C. A., & Rodríguez, A. (2018). Learning from R&D outsourcing vs. learning by R&D outsourcing. Technovation, 72, 24-33.

- (Article) Van de Poel, I. (2003). The transformation of technological regimes. Research Policy, 32(1), 49-68.

- (Article) Van de Vrande, V. (2013). Balancing your technology‐sourcing portfolio: How sourcing mode diversity enhances innovative performance. Strategic Management Journal, 34(5), 610-621.

- (Article) Vanhaverbeke, W., Duysters, G., & Noorderhaven, N. (2002). External technology sourcing through alliances or acquisitions: An analysis of the application-specific integrated circuits industry. Organization Science, 13(6), 714-733.

- (Article) Vasudeva, G., & Anand, J. (2011). Unpacking absorptive capacity: A study of knowledge utilization from alliance portfolios. Academy of Management Journal, 54(3), 611-623.

- (Article) Viotti, E. B. (2002). National learning systems: a new approach on technological change in late industrializing economies and evidences from the cases of Brazil and South Korea. Technological Forecasting and Social Change, 69(7), 653-680.

- (Article) Volberda, H. W., Foss, N. J., & Lyles, M. A. (2010). Perspective—Absorbing the concept of absorptive capacity: How to realize its potential in the organization field. Organization Science, 21(4), 931-951.

- (Article) Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185-203.

- (Article) Zobel, A.K. (2017). Benefiting from open innovation: A multidimensional model of absorptive capacity. Journal of Product Innovation Management, 34(3), 269-288.

Explore untapped customer needs: user-centric innovation

Keywords: cocreation, customer analytics, ethnography, lead users, living labs, market research, quality function deployment, toolkits, untapped customer needs, user-centric innovations, value gaps

- (Book) Christensen, C., Karen Dillon, Taddy Hall, & Duncan, D.S. (2016) Competing Against Luck: The Story of Innovation and Customer Choice, Harper Business.

- (Book) Living Labs: Best of TIM Review; Dec 18, 2015 by Mika Westerlund and Seppo Leminen

- (Book) Management of the Fuzzy Front End of Innovation; Oct 8, 2013 by Oliver Gassmann and Fiona Schweitzer

- (Book) Thallmaier, S. R. (2014). Customer co-design: A study in the mass customization industry. Springer.

- (Video) http://livinglab.mit.edu/

- (Video) How Qualitative Research Shapes the Innovation Process by Kuczmarski Innovation (on Vimeo)

- (Article) Antorini, Y.M., Muñiz Jr, A.M., & Askildsen, T. (2012). Collaborating with customer communities: Lessons from the Lego group. MIT Sloan Management Review, 53(3), 73-79.

- (Article) Bala I., M. Subramaniam, & Srinivasa Rangan, U. (2017). The Next Battle in Antitrust Will Be About Whether One Company Knows Everything About You. Harvard Business Review, July 06, 2017.

- (Article) Baldwin, C., Hienerth, C., & Von Hippel, E. (2006). How user innovations become commercial products: A theoretical investigation and case study. Research Policy, 35(9), 1291-1313.

- (Article) Belz, F. M., & Baumbach, W. (2010). Netnography as a method of lead user identification. Creativity and Innovation Management, 19(3), 304-313.

- (Article) Bettencourt, L.A., & Ulwick, A.W. (2008). The customer-centered innovation map. Harvard Business Review, 86(5), 109.

- (Article) Bogers, M., Afuah, A., & Bastian, B. (2010). Users as innovators: a review, critique, and future research directions. Journal of Management, 36(4), 857-875.

- (Article) Bohlmann, Jonathan D., et al. “The interplay of customer and product innovation dynamics: an exploratory study.” Journal of Product Innovation Management 30.2 (2013): 228-244.

- (Article) Callahan, J., & Lasry, E. (2004). The importance of customer input in the development of very new products. R&D Management, 34(2), 107-120.

- (Article) Coviello, N. E., & Joseph, R. M. (2012). Creating major innovations with customers: Insights from small and young technology firms. Journal of Marketing, 76(6), 87-104

- (Article) Day, G. S. (1994). The capabilities of market-driven organizations. the Journal of Marketing, 37-52.

- (Article) Dell’Era, C., & Landoni, P. (2014). Living Lab: A methodology between user‐centred design and participatory design. Creativity and Innovation Management, 23(2), 137-154.

- (Article) Edvardsson, B., Kristensson, P., Magnusson, P., & Sundström, E. (2012). Customer integration within service development—A review of methods and an analysis of insitu and exsitu contributions. Technovation, 32(7-8), 419-429.

- (Article) Enkel, E., Perez‐Freije, J., & Gassmann, O. (2005). Minimizing market risks through customer integration in new product development: learning from bad practice. Creativity and Innovation Management, 14(4), 425-437.

- (Article) Etgar, M. (2008). A descriptive model of the consumer co-production process. Journal of the Academy of Marketing Science, 36(1), 97-108.

- (Article) Fang, E. (2008). Customer participation and the trade-off between new product innovativeness and speed to market. Journal of Marketing, 72(4), 90-104.

- (Article) Foss, N. J., Laursen, K., & Pedersen, T. (2011). Linking customer interaction and innovation: The mediating role of new organizational practices. Organization Science, 22(4), 980-999.

- (Article) Franke, N., & Shah, S. (2003). How communities support innovative activities: an exploration of assistance and sharing among end-users. Research Policy, 32(1), 157-178.

- (Artilce) Franke, N., & Piller, F. (2004). Value creation by toolkits for user innovation and design: The case of the watch market. Journal of Product Innovation Management, 21(6), 401-415.

- (Article) Franke, N., Von Hippel, E., & Schreier, M. (2006). Finding commercially attractive user innovations: A test of lead‐user theory. Journal of Product Innovation Management, 23(4), 301-315.

- (Article) Franke, N., & Hader, C. (2014). Mass or only “niche customization”? Why we should interpret configuration toolkits as learning instruments. Journal of Product Innovation Management, 31(6), 1214-1234.

- (Article) Fuchs, C., & Schreier, M. (2011). Customer empowerment in new product development. Journal of Product Innovation Management, 28(1), 17-32.

- (Article) Gassmann, O., Kausch, C., & Enkel, E. (2010). Negative side effects of customer integration. International Journal of Technology Management, 50(1), 43-62.

- (Article) Greer, C. R., & Lei, D. (2012). Collaborative innovation with customers: A review of the literature and suggestions for future research. International Journal of Management Reviews, 14(1), 63-84.

- (Article) Hang, C. C., Garnsey, E., & Ruan, Y. (2015). Opportunities for disruption. Technovation, 39, 83-93.

- (Article) Herstatt, C., & Von Hippel, E. (1992). From experience: Developing new product concepts via the lead user method: A case study in a “low-tech” field. Journal of Product Innovation Management, 9(3), 213-221.

- (Article) Hoholm, T., & Araujo, L. (2011). Studying innovation processes in real-time: The promises and challenges of ethnography. Industrial Marketing Management, 40(6), 933-939.

- (Article) Hopkins, M. M., Tidd, J., Nightingale, P., & Miller, R. (2011). Generative and degenerative interactions: positive and negative dynamics of open, user‐centric innovation in technology and engineering consultancies. R&D Management, 41(1), 44-60.

- (Article) Hoyer, W. D., Chandy, R., Dorotic, M., Krafft, M., & Singh, S. S. (2010). Consumer cocreation in new product development. Journal of Service Research, 13(3), 283-296.

- (Article) Hudson, L. A., & Ozanne, J. L. (1988). Alternative ways of seeking knowledge in consumer research. Journal of Consumer Research, 14(4), 508-521.

- (Article) Hyysalo, S. (2009). User innovation and everyday practices: micro‐innovation in sports industry development. R&D Management, 39(3), 247-258.

- (Article) Jeppesen, L. B., & Molin, M. J. (2003). Consumers as co-developers: Learning and innovation outside the firm. Technology Analysis & Strategic Management, 15(3), 363-383.

- (Article) Jeppesen, L.B., & Frederiksen, L. (2006). Why do users contribute to firm-hosted user communities? The case of computer-controlled music instruments, Organization Science, 17(1), 45-63

- (Article) Lettl, C., Herstatt, C., & Gemuenden, H. G. (2006). Users’ contributions to radical innovation: evidence from four cases in the field of medical equipment technology. R&D Management, 36(3), 251-272.

- (Article) Lilien, G. L., Morrison, P. D., Searls, K., Sonnack, M., & Hippel, E. V. (2002). Performance assessment of the lead user idea-generation process for new product development. Management Science, 48(8), 1042-1059.

- (Article) Lüthje, C. (2004). Characteristics of innovating users in a consumer goods field: An empirical study of sport-related product consumers. Technovation, 24(9), 683-695.

- (Article) Lüthje, C., & Herstatt, C. (2004). The Lead User method: an outline of empirical findings and issues for future research. R&D Management, 34(5), 553-568.

- (Article) Lüthje, C., Herstatt, C., & Von Hippel, E. (2005). User-innovators and “local” information: The case of mountain biking. Research Policy, 34(6), 951-965.

- (Article) Magnusson, P. R., Matthing, J., & Kristensson, P. (2003). Managing user involvement in service innovation: Experiments with innovating end users. Journal of Service Research, 6(2), 111-124.

- (Article) Magnusson, P. R. (2009). Exploring the contributions of involving ordinary users in ideation of technology‐based services. Journal of Product Innovation Management, 26(5), 578-593.

- (Article) Mahr, D., Lievens, A., & Blazevic, V. (2014). The value of customer cocreated knowledge during the innovation process. Journal of Product Innovation Management, 31(3), 599-615.

- (Article) Matzler, K., & Hinterhuber, H. H. (1998). How to make product development projects more successful by integrating Kano’s model of customer satisfaction into quality function deployment. Technovation, 18(1), 25-38.

- (Article) Morrison, P. D., Roberts, J. H., & Midgley, D. F. (2004). The nature of lead users and measurement of leading edge status. Research Policy, 33(2), 351-362.

- (Article) Morrison, P. D., Roberts, J. H., & Von Hippel, E. (2000). Determinants of user innovation and innovation sharing in a local market. Management Science, 46(12), 1513-1527

- (Article) Mukerjee, K. (2013). Customer-oriented organizations: a framework for innovation. Journal of Business Strategy, 34(3), 49-56.

- (Article) Norton, M. I., Mochon, D., & Ariely, D. (2012). The IKEA effect: When labor leads to love. Journal of Consumer Psychology, 22(3), 453-460.

- (Article) Paladino, A. (2007). Investigating the drivers of innovation and new product success: a comparison of strategic orientations. Journal of Product Innovation Management, 24(6), 534-553.

- (Article) Parmentier, G., & Mangematin, V. (2014). Orchestrating innovation with user communities in the creative industries. Technological Forecasting and Social Change, 83, 40-53.

- (Article) Piller, F. T., & Walcher, D. (2006). Toolkits for idea competitions: a novel method to integrate users in new product development. R&D Management, 36(3), 307-318.

- (Article) Prahalad, C. K., & Ramaswamy, V. (2000). Co-opting customer competence. Harvard Business Review, 78(1), 79-90.

- (Article) Raasch, C., Herstatt, C., & Balka, K. (2009). On the open design of tangible goods. R&D Management, 39(4), 382-393.

- (Article) Sandmeier, P., Morrison, P. D., & Gassmann, O. (2010). Integrating customers in product innovation: lessons from industrial development contractors and in‐house contractors in rapidly changing customer markets. Creativity and Innovation Management, 19(2), 89-106.

- (Article) Sawhney, M., Verona, G., & Prandelli, E. (2005). Collaborating to create: The Internet as a platform for customer engagement in product innovation. Journal of Interactive Marketing, 19(4), 4-17.

- (Article) Schreier, Martin, Stefan Oberhauser, and Reinhard Prügl. “Lead users and the adoption and diffusion of new products: Insights from two extreme sports communities.” Marketing Letters 18.1-2 (2007): 15-30.

- (Article) Schweisfurth, T., & Raasch, C. (2015). ‘Embedded lead users-The benefits of employing users from corporate innovation’. Research Policy, 44, 168-180.

- (Article) Slater, S. F., & Narver, J. C. (2000). Intelligence generation and superior customer value. Journal of the Academy of Marketing Science, 28(1), 120.

- (Article) Urban, G. L., & Von Hippel, E. (1988). Lead user analyses for the development of new industrial products. Management Science, 34(5), 569-582.

- (Article) Verganti, R. (2008). Design, meanings, and radical innovation: A metamodel and a research agenda. Journal of Product Innovation Management, 25(5), 436-456.

- (Article) Veryzer, R. W., & Borja de Mozota, B. (2005). The impact of user‐oriented design on new product development: An examination of fundamental relationships. Journal of Product Innovation Management, 22(2), 128-143

- (Article) Von Hippel, E. (1986). Lead users: a source of novel product concepts. Management Science, 32(7), 791-805.

- (Article) Von Hippel, E. (2001). User toolkits for innovation. Journal of Product Innovation Management, 18(4), 247-257.

- (Article) Von Hippel, E., & Katz, R. (2002). Shifting innovation to users via toolkits. Management Science, 48(7), 821-833.

- (Article) Voorberg, W. H., Bekkers, V. J., & Tummers, L. G. (2015). A systematic review of co-creation and co-production: Embarking on the social innovation journey. Public Management Review, 17(9), 1333-1357.

- (Article) Wiertz, C., & de Ruyter, K. (2007). Beyond the call of duty: Why customers contribute to firm-hosted commercial online communities. Organization Studies, 28(3), 347-376.

- (Article) Xu, Z., Frankwick, G. L., & Ramirez, E. (2016). Effects of big data analytics and traditional marketing analytics on new product success: A knowledge fusion perspective. Journal of Business Research, 69(5), 1562-1566.

- (Article) Zhong, W., Ma, Z., Tong, T. W., Zhang, Y., & Xie, L. (2020). Customer Concentration, Executive Attention, and Firm Search Behavior. Academy of Management Journal, (ja).

Seeding new ventures: corporate venture capital

Keywords: acquisitions, corporate venture capital, objectives of corporate venture capital, hackatons, innovation contests, innovation prizes

- (Book) Landström, Hans, ed. Handbook of research on venture capital. Edward Elgar Publishing, 2007.

- (Book) Maula, Markku VJ. Corporate venture capital and the value-added for technology-based new firms. Helsinki University of Technology, 2001.

- (Video) Biopharma Health MIT Hackathon

- (Video) Connecting Companies of All Sizes through Innovation by Kuczmarski Innovation (on Vimeo)

- (Video) The UBS Hackaton (on UBS website)

- (Article) Adamczyk, S., Bullinger, A. C., & Möslein, K. M. (2012). Innovation contests: A review, classification and outlook. Creativity and Innovation Management, 21(4), 335-360.

- (Article) Ahuja, G., & Katila, R. (2001). Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strategic Management Journal, 22(3), 197-220.

- (Article) Alvarez‐Garrido, E., & Dushnitsky, G. (2016). Are entrepreneurial venture’s innovation rates sensitive to investor complementary assets? Comparing biotech ventures backed by corporate and independent VCs. Strategic Management Journal, 37(5), 819-834.

- (Article) Arora, A., & Gambardella, A. (2010). Ideas for rent: an overview of markets for technology. Industrial and Corporate Change, 19(3), 775-803.

- (Article) Basu, S., Phelps, C., & Kotha, S. (2011). Towards understanding who makes corporate venture capital investments and why. Journal of Business Venturing, 26(2), 153-171.

- (Article) Becker, B., & Gassmann, O. (2006). Gaining leverage effects from knowledge modes within corporate incubators. R&D Management, 36(1), 1-16.

- (Article) Belderbos, R., Jacob, J., & Lokshin, B., (2018). Corporate venture capital (CVC) investments and technological performance: Geographic diversity and the interplay with technology alliances, Journal of Business Venturing, 33(1), 20-34.

- (Article) Benson, David, and Rosemarie H. Ziedonis. “Corporate venture capital as a window on new technologies: Implications for the performance of corporate investors when acquiring startups.” Organization Science 20.2 (2009): 329-351.

- (Article) Block, Zenas, and Oscar A. Ornati. “Compensating corporate venture managers.” Journal of Business Venturing 2.1 (1987): 41-51.

- (Article) Boudreau, K. J., Lacetera, N., & Lakhani, K. R. (2011). Incentives and problem uncertainty in innovation contests: An empirical analysis. Management Science, 57(5), 843-863.

- (Article) Bullinger, A. C., Neyer, A. K., Rass, M., & Moeslein, K. M. (2010). Community‐based innovation contests: Where competition meets cooperation. Creativity and Innovation Management, 19(3), 290-303.

- (Article) Chemmanur, T. J., Loutskina, E., & Tian, X. (2014). Corporate venture capital, value creation, and innovation. The Review of Financial Studies, 27(8), 2434-2473.

- (Article) Chesbrough, H. (2000). Designing corporate ventures in the shadow of private venture capital. California Management Review, 42(3), 31-49.

- (Article) Cloodt, M., Hagedoorn, J., & Van Kranenburg, H. (2006). Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Research Policy, 35(5), 642-654.

- (Article) Colombo, M. G., & Shafi, K. (2016). Swimming with sharks in Europe: When are they dangerous and what can new ventures do to defend themselves?. Strategic Management Journal, 37(11), 2307-2322.

- (Article) Covin, J.G., & Miles, M.P. (2007). Strategic use of corporate venturing. Entrepreneurship Theory and Practice, 31(2), 183-207.

- (Article) Dushnitsky, G., & Lenox, M.J. (2005). When do incumbents learn from entrepreneurial ventures?: Corporate venture capital and investing firm innovation rates. Research Policy, 34(5), 615-639.

- (Article) Dushnitsky, G., & Lenox, M. J. (2005). When do firms undertake R&D by investing in new ventures?. Strategic Management Journal, 26(10), 947-965.

- (Article) Dushnitsky, G., & Lenox, M.J. (2006). When does corporate venture capital investment create firm value?. Journal of Business Venturing, 21(6), 753-772.

- (Article) Dushnitsky, G., & Shapira, Z. (2010). Entrepreneurial finance meets organizational reality: Comparing investment practices and performance of corporate and independent venture capitalists. Strategic Management Journal, 31(9), 990-1017.

- (Article) Dushnitsky, G., & Shaver, J. M. (2009). Limitations to interorganizational knowledge acquisition: The paradox of corporate venture capital. Strategic Management Journal, 30(10), 1045-1064.

- (Article) Enkel, E., & Sagmeister, V. (2020). External corporate venturing modes as new way to develop dynamic capabilities. Technovation, 102128.

- (Article) Ernst, H., Witt, P., & Brachtendorf, G. (2005). Corporate venture capital as a strategy for external innovation: an exploratory empirical study. R&D Management, 35(3), 233-242.

- (Article) Füller, J., Hutter, K., & Faullant, R. (2011). Why co‐creation experience matters? Creative experience and its impact on the quantity and quality of creative contributions. R&D Management, 41(3), 259-273.

- (Article) Gaba, V., & Bhattacharya, S. (2012). Aspirations, innovation, and corporate venture capital: A behavioral perspective. Strategic Entrepreneurship Journal, 6(2), 178-199.

- (Article) Gans, J. S., Hsu, D. H., & Stern, S. (2002). When does start-up innovation spur the gale of creative destruction?. RAND Journal of Economics, 33(4), 571-587.

- (Article) Gompers, Paul, and Josh Lerner. “Venture capital distributions: Short‐run and long‐run reactions.” The Journal of Finance 53.6 (1998): 2161-2183.

- (Article) Hellmann, T. (2002). A theory of strategic venture investing. Journal of Financial Economics, 64(2), 285-314.

- (Article) Hofstetter, R., Dahl, D. W., Aryobsei, S., & Herrmann, A. (2021). Constraining Ideas: How Seeing Ideas of Others Harms Creativity in Open Innovation. Journal of Marketing Research, 58(1), 95-114.

- (Article) Huang, P., & Madhavan, R. Dumb Money or Smart Money? Meta‐Analytically Unpacking Corporate Venture Capital. Strategic Entrepreneurship Journal. doi:10.1002/sej.1369

- (Article) Hutter, K., Hautz, J., Füller, J., Mueller, J., & Matzler, K. (2011). Communitition: The tension between competition and collaboration in community‐based design contests. Creativity and Innovation Management, 20(1), 3-21.

- (Article) Ivanov, V. I., & Xie, F. (2010). Do corporate venture capitalists add value to start‐up firms? Evidence from IPOs and acquisitions of VC‐backed companies. Financial Management, 39(1), 129-152.

- (Article) Kapoor, R., & Lim, K. (2007). The impact of acquisitions on the productivity of inventors at semiconductor firms: A synthesis of knowledge-based and incentive-based perspectives. Academy of Management Journal, 50(5), 1133-1155.

- (Article) Kay, L. (2011). The effect of inducement prizes on innovation: evidence from the Ansari XPrize and the Northrop Grumman Lunar Lander Challenge. R&D Management, 41(4), 360-377.

- (Article) Keil, T. (2004). Building external corporate venturing capability. Journal of Management Studies, 41(5), 799-825.

- (Article) Keil, T., Maula, M., Schildt, H., & Zahra, S. A. (2008). The effect of governance modes and relatedness of external business development activities on innovative performance. Strategic Management Journal, 29(8), 895-907.

- (Article) Knoben, J., & Bakker, R. M. (2019). The guppy and the whale: Relational pluralism and start-ups’ expropriation dilemma in partnership formation. Journal of Business Venturing 34(1), 103-121

- (Article) Lakhani, K. R., Boudreau, K. J., Loh, P. R., Backstrom, L., Baldwin, C., Lonstein, E., … & Guinan, E. C. (2013). Prize-based contests can provide solutions to computational biology problems. Nature Biotechnology, 31(2), 108.

- (Article) Lee, S. U., Park, G., & Kang, J. (2018). The double-edged effects of the corporate venture capital unit’s structural autonomy on corporate investors’ explorative and exploitative innovation. Journal of Business Research, 88, 141-149

- (Article) Maula, M., Autio, E., & Murray, G. (2003). Prerequisites for the creation of social capital and subsequent knowledge acquisition in corporate venture capital. Venture Capital: An International Journal of Entrepreneurial Finance, 5(2), 117-134

- (Article) Maula, M., Autio, E., & Murray, G. (2005). Corporate venture capitalists and independent venture capitalists: What do they know, who do they know and should entrepreneurs care?. Venture Capital: An International Journal of Entrepreneurial Finance, 7(1), 3-21.

- (Article) Maula, M. V., Keil, T., & Zahra, S.A. (2013). Top management’s attention to discontinuous technological change: Corporate venture capital as an alert mechanism. Organization Science, 24(3), 926-947.

- (Article) Miller, A., & Camp, B. (1985). Exploring determinants of success in corporate ventures. Journal of Business Venturing, 1(1), 87-105.

- (Article) Minshall, T., Mortara, L., Valli, R., & Probert, D. (2010). Making “asymmetric” partnerships work. Research-Technology Management, 53(3), 53-63.

- (Article) Murray, F., Stern, S., Campbell, G., & MacCormack, A. (2012). Grand Innovation Prizes: A theoretical, normative, and empirical evaluation. Research Policy, 41(10), 1779-1792.

- (Article) PolidoroJr, F., & Yang, W. (2021). Corporate Investment Relationships and the Search for Innovations: An Examination of Startups’ Search Shift Toward Incumbents. Organization Science.

- (Article) Puranam, P., Singh, H., & Zollo, M. (2006). Organizing for innovation: Managing the coordination-autonomy dilemma in technology acquisitions. Academy of Management Journal, 49(2), 263-280.

- (Article) Puranam, P., & Srikanth, K. (2007). What they know vs. what they do: How acquirers leverage technology acquisitions. Strategic Management Journal, 28(8), 805-825.

- (Article) Rothaermel, F. T. (2001). Complementary assets, strategic alliances, and the incumbent’s advantage: an empirical study of industry and firm effects in the biopharmaceutical industry. Research Policy, 30(8), 1235-1251.

- (Article) Rothaermel, F. T. (2001). Incumbent’s advantage through exploiting complementary assets via interfirm cooperation. Strategic Management Journal, 22(6‐7), 687-699.

- (Article) Schildt, H. A., Maula, M. V., & Keil, T. (2005). Explorative and exploitative learning from external corporate ventures. Entrepreneurship Theory and Practice, 29(4), 493-515.

- (Article) Shrader, R. C., & Simon, M. (1997). Corporate versus independent new ventures: Resource, strategy, and performance differences. Journal of Business Venturing, 12(1), 47-66.

- (Article) Souitaris, V., Zerbinati, S., & Liu, G. (2012). Which iron cage? Endo-and exoisomorphism in corporate venture capital programs. Academy of Management Journal, 55(2), 477-505.

- (Article) Souitaris, V., & Zerbinati, S. (2014). How do corporate venture capitalists do deals? An exploration of corporate investment practices. Strategic Entrepreneurship Journal, 8(4), 321-348.

- (Article) Sykes, H. B. (1990). Corporate venture capital: Strategies for success. Journal of Business Venturing, 5(1), 37-47.

- (Article) Sykes, H. B. (1986). The anatomy of a corporate venturing program: Factors influencing success. Journal of Business Venturing, 1(3), 275-293.

- (Article) Terwiesch, C., & Xu, Y. (2008). Innovation contests, open innovation, and multiagent problem solving. Management Science, 54(9), 1529-1543.

- (Article) Wadhwa, A., & Kotha, S. (2006). Knowledge creation through external venturing: Evidence from the telecommunications equipment manufacturing industry. Academy of Management Journal, 49(4), 819-835.

- (Article) Wadhwa, A., Phelps, C., & Kotha, S. (2016). Corporate venture capital portfolios and firm innovation. Journal of Business Venturing, 31(1), 95-112.

- (Article) Williams, H. (2012). Innovation inducement prizes: Connecting research to policy. Journal of Policy Analysis and Management, 31(3), 752-776.

- (Article) Yang, Y., Narayanan, V. K., & De Carolis, D. M. (2014). The relationship between portfolio diversification and firm value: The evidence from corporate venture capital activity. Strategic Management Journal, 35(13), 1993-2011.

- (Article) Yang, H., Zheng, Y., & Zhao, X. (2014). Exploration or exploitation? Small firms’ alliance strategies with large firms. Strategic Management Journal, 35(1), 146-157.

(c) Prof. Benoit Gailly, Louvain School of Management